Bank of Canada Cuts Rates for Third Time: What Homebuyers and Investors Need to Know

Three Consecutive Rate Cuts: What’s Next for the Canadian Economy?

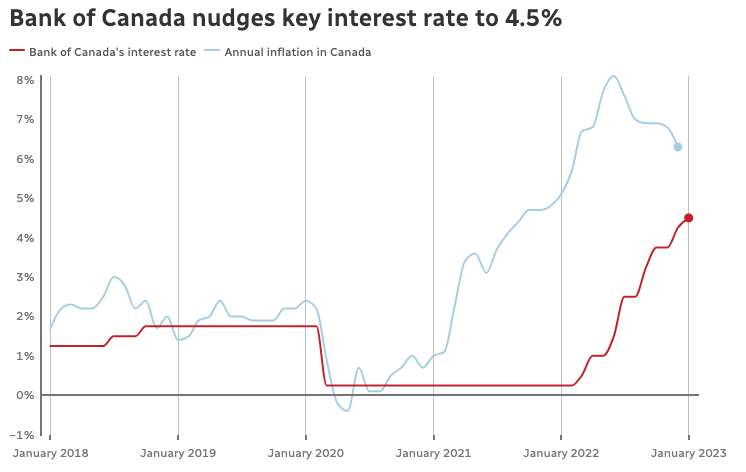

In a highly anticipated move, the Bank of Canada (BoC) has lowered its key interest rate by 25 basis points, bringing it down to 4.25%. This marks the third consecutive cut since June, signaling the central bank’s ongoing efforts to navigate the complexities of Canada’s economic landscape. While the reduction was largely expected, the broader implications of this decision reflect the central bank’s cautious approach to managing inflation and sustaining economic growth.

Why the Rate Cut Matters

The Bank of Canada’s decision to reduce the policy rate has wide-reaching effects, particularly for consumers and businesses who rely on borrowing. The current 4.25% rate directly influences variable mortgage rates, lines of credit, and business loans, making the cost of borrowing slightly more manageable. However, while these cuts offer some relief, their impact may be muted, especially for the housing market, which continues to face persistent challenges.

Governor Tiff Macklem emphasized that while inflation has cooled to 2.5%, it remains stubborn in areas like housing, where shelter costs are running at over 8%. Housing represents a significant portion of consumer spending, and despite easing in other sectors, this is one area where inflationary pressures remain high, complicating efforts to bring overall inflation down to the BoC’s 2% target.

Impact on the Housing Market

For those looking to buy a home, the latest rate cut might offer modest savings, but experts caution that it’s unlikely to dramatically shift the housing market. A 25-basis-point cut, for instance, results in a savings of approximately $125 per month on a $500,000 loan for a buyer with a variable rate mortgage. While this can provide some financial relief, it’s not a game-changer for most prospective buyers, many of whom continue to face affordability issues amid high housing costs.

Local real estate professionals are observing that these incremental cuts are helping to stabilize, but not fully stimulate, the housing market. For those already in the market or looking to enter it, these rate adjustments signal an improvement, but not enough to fully counteract the high costs associated with homeownership today.

Source: Bank of Canada, Statistics Canada

Chart: Graeme Bruce | CBN News

Employment and Broader Economic Implications

Another concern for the Bank of Canada is the labor market, which has shown signs of softening. The unemployment rate has climbed to 6.4%, with a notable impact on youth and newcomers. While wage growth remains elevated, it is expected to slow as the slack in the labor market persists. The BoC is closely monitoring these dynamics, as they will influence future decisions about the pace and size of any additional rate cuts.

Globally, economic growth has been better than expected, particularly in the U.S., where consumer spending continues to drive the economy. However, slowdowns in other major economies, like China, and overall weaker labor markets add uncertainty to the global outlook. For Canada, maintaining economic momentum while balancing inflationary pressures is key.

What’s Next for Interest Rates?

Looking ahead, Governor Macklem has left the door open for further rate cuts, potentially as soon as October, depending on how the economy performs in the coming months. The central bank is carefully assessing the risk of inflation either falling below the 2% target or remaining too high. While a 25-basis-point reduction was seen as a prudent move, larger cuts could be on the table if economic conditions worsen or inflation proves more persistent.

Many economists predict that we could see another rate cut before the end of the year, with the potential for continued easing into 2025. However, this will depend on incoming data, particularly around employment, inflation, and consumer spending.

The Bank of Canada’s latest interest rate cut is part of its broader strategy to guide the Canadian economy toward a “soft landing” as it aims to balance inflation control with sustainable growth. While the rate reduction provides some relief, particularly for borrowers, its immediate effects may be less dramatic than some had hoped. The housing market, in particular, remains a challenge, and the BoC’s focus will likely remain on managing inflationary pressures in this sector.

As the central bank continues to assess economic conditions, Canadians can expect a measured approach to monetary policy, with the potential for further rate cuts if needed. For now, the BoC remains committed to restoring price stability while keeping the economy on course for a stable and prosperous future.

Share This Article